The accounting & tax app for landlords &

self-employed people

Coconut’s simple tax app helps self-employed people track income, manage invoicing, claim expenses, and work out how much to set aside for tax.

and credit card accounts:

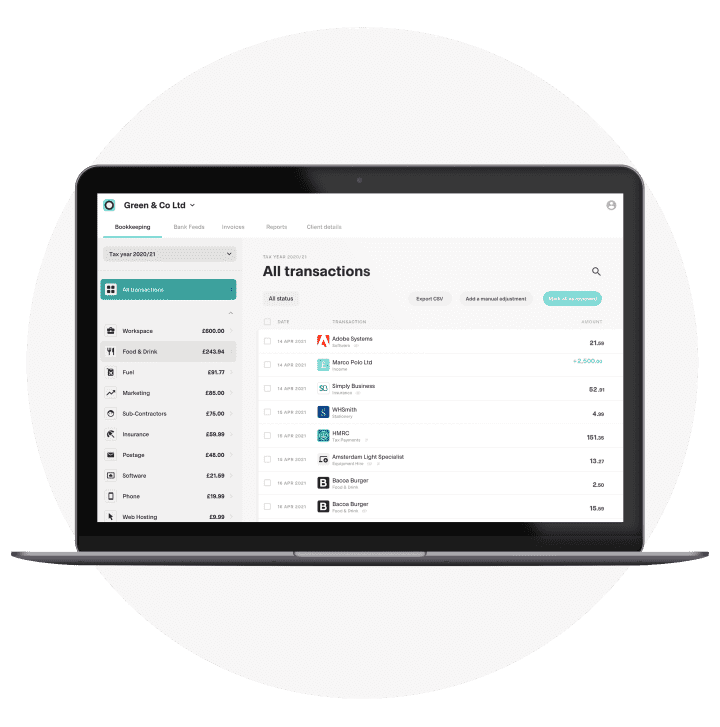

Get your finances organised

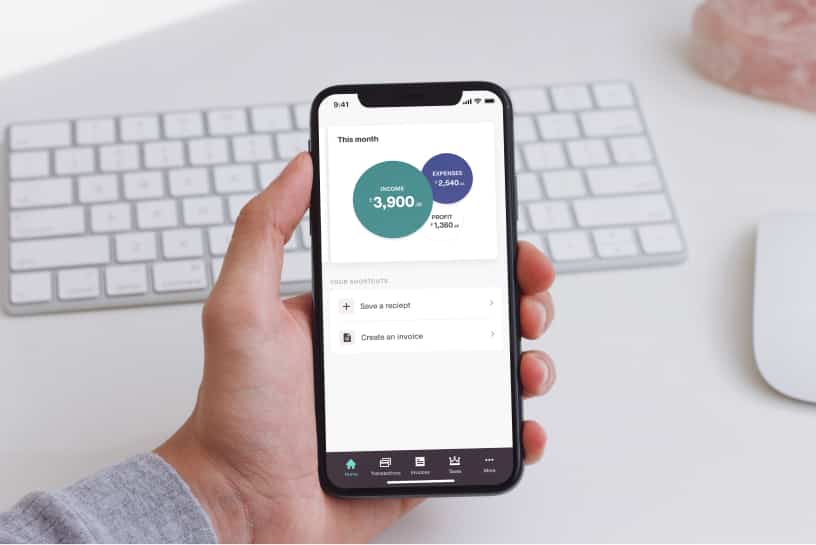

Coconut helps you unmuddle your business, property and personal finances, so that you always have accurate figures at your fingertips. Making it easy to see how business is doing, any payments that are overdue, and what to set aside for tax every single month.

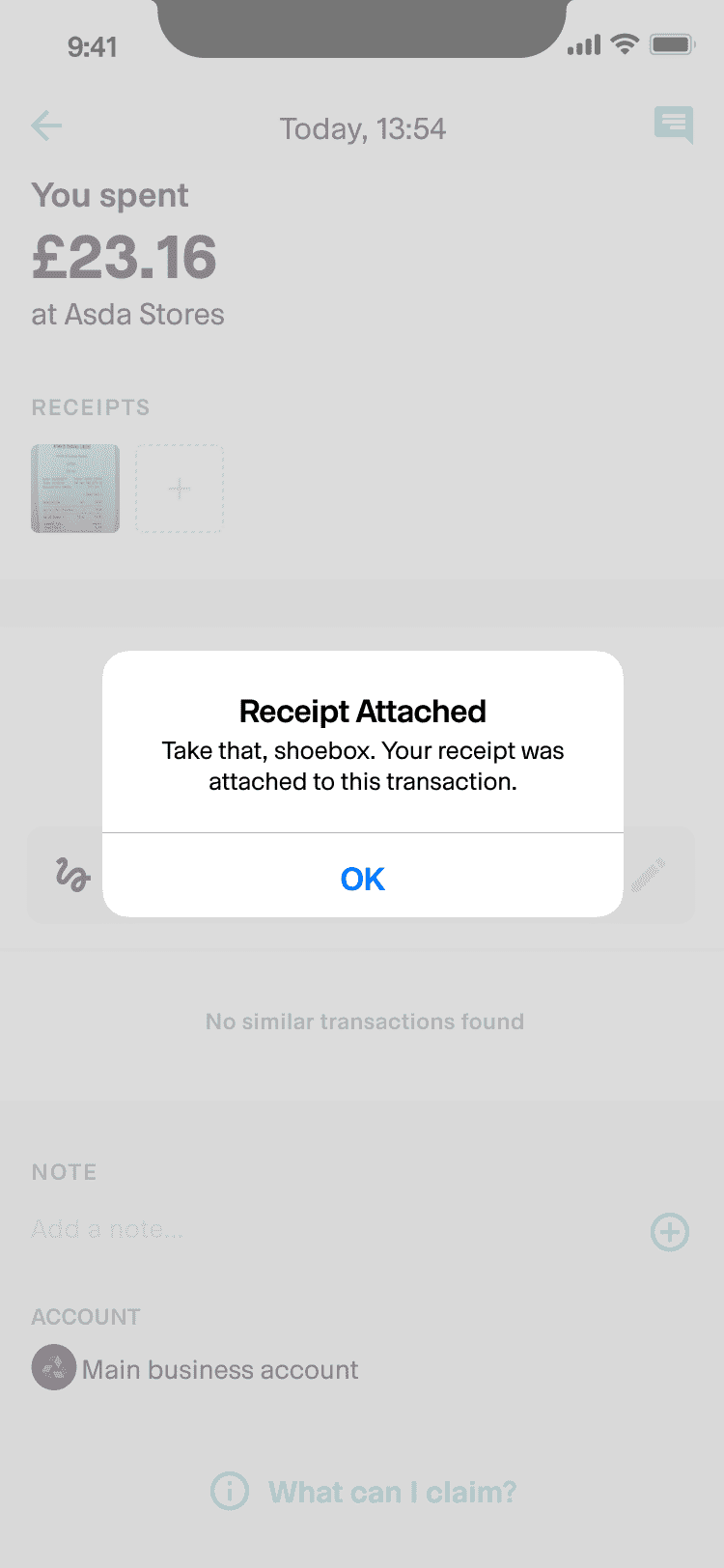

Spend less time on financial admin

Tired of wasting valuable client-time on spreadsheets, paperwork, and tax returns? The tools in our accounting and tax app help you do all of your financial admin in a fraction of the time; freeing you up to focus on the important stuff.

Build the foundations for success

Getting the money-side right is a key pillar of building a successful self-employed or landlord business. By automating admin tasks and helping you stay on top of your finances as you go, Coconut's accounting and tax app helps you lay the foundations you need to thrive.

Coconut's tax app integrates with 30+ UK bank and credit card accounts:

Be ready for quarterly tax returns

With Making Tax Digital for Income Tax due to come into effect in 2026, certain sole traders and landlords will be required to complete four tax submissions a year using a digital product—like Coconut. Our tax app will make the transition seamless; sign up now to get ahead.

What our customers say

“As soon as I started using [Coconut] I thought, wow—this is so easy and convenient, and almost addictive in a way. It has really, really helped me lighten the load, so that I can focus more on other things”

"Such a great app. It's so useful and is a pleasure to use. I did the majority of my tax return walking in a park, rather than agonising over bank statements with a calculator.”

“Within half an hour, everything was in order, everything made sense and the worries faded away. What a fantastic app. Easy to use, good looking with a beautiful UI/UX. It's a pleasure to have it in my armoury!”

Spend a little each month, save a lot at the end of the tax year

Join thousands of sole traders and landlords using Coconut to get their finances in order, all for less than a few lattes each month—a lot less than unpaid invoices, forgotten expenses, or an unexpected tax bill.

- Connect accounts from 30+ banks and credit cards

- Track your income and expenses throughout the year

- Access Coconut on both mobile and desktop

- Send and track unlimited branded invoices

- Always know how much tax to set aside

- Easily share access with your accountant

Common questions

Yes you can. We offer everyone a 30-day free trial (no card details required), so you can see how Coconut works.

Coconut is designed specifically for sole traders. Designed to give you a view of how your business is performing, help you work out how much tax you owe and track income and expenses. If you want to spend more time focusing on your business and not your accounting, Coconut is for you.

No, Coconut is not a bank and we do not offer banking or current account services. Coconut is a simple tax app for self-employed people and accountants.

Sole traders can connect their personal bank or current accounts to Coconut and begin to separate their business and personal transactions.

You can get in touch with us through the in-app chat or by emailing support@getcoconut.com.

You can connect bank accounts and credit cards from over 25 UK providers. Take a look at the full list here.

Yes, you can! Users on either of our plans can access Coconut Web on desktop. To log in, simply use your existing mobile number and pin.

Tools, tips and interesting reads

From tips on taxes to Self Assessments and expenses, we have advice for sole traders and landlords in all stages of their journey.

.png)