Update 23/09/22: the Health & Social Care Levy was scrapped in the mini-budget of 23rd September 2022. The government has announced that the funding for health and social care will now come from general taxation.

In 2021, the government outlined plans that would increase National Insurance Contributions, in a bid to invest more in UK health and social care over the next three years. This is known as the Health and Social Care Levy.

The bill is set to raise around £12 billion in extra funding per year, which will initially go towards easing pressure on the NHS, and then to support the social care system.

Now that the 2022/23 tax year is upon us, the Health and Social Care Levy is due to take effect. But how much is it, what exactly does it involve, and what impact will it have on the self-employed community? We've summarised all you need to know in this blog.

How much is the Health and Social Care Levy and when will it come into effect?

From 6th April 2022—the new tax year—the government will introduce a 1.25% increase in National Insurance Contributions for employees, employers, and self-employed people alike.

Then, from April 2023, National Insurance will return to its current rate, and the extra tax will instead be collected as the new Health and Social Care Levy.

(The temporary National Insurance rise is purely because HMRC would not have been able to introduce a new tax in time for April 2022. The impact on taxpayers is largely the same from 2022 onwards—bar a few differences outlined below).

Who pays the Health and Social Care Levy?

Between 6 April 2022 and 5 April 2023

If you’re an employer, employee, or self-employed, and you're below the State Pension age, you’re liable to pay the 1.25% increase in National Insurance Contributions.

From 6 April 2023 onwards

From the next tax year, National Insurance Contributions will return to normal and the separate levy of 1.25% will apply.

Whilst individuals above State Pension age won’t be affected by the temporary increase to National Insurance contributions in the 2022/23 tax year, they will be liable to pay the levy from April 2023.

How will the Health and Social Care Levy affect me as a sole trader?

The levy will apply to all individuals, whether self-employed or employed. But below, we’ll outline specifically how it will impact self-employed sole traders.

As a self-employed sole trader, you pay two types of National Insurance: Class 2 and Class 4 (read more on NI here). The levy will be applied to Class 4 NIC (National Insurance Contributions) only—Class 2 NIC are not impacted.

Your 2021/22 Class 4 NIC will not change:

- 9% on profits between £9,569 and £50,270

- A further 2% on profits over £50,270

However from 2022/23, Class 4 NIC will be:

- 10.25% on profits between £9,569 and £50,270

- A further 3.25% on profits over £50,270

So, how much Health and Social Care Levy will I pay?

Of course, the exact amount you’ll pay depends on your income. But let’s look at an example of how this could affect your available cash.

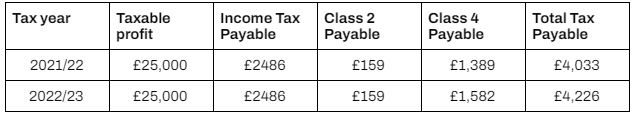

If you’re a sole trader that has made a profit of £25,000 with no further sources of income, the personal allowance remains £12,570, and Class 2 NIC will remain the same. As you can see below, the total tax payable has increased by £193 for the tax year.

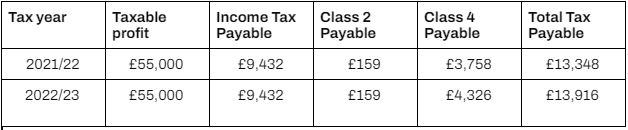

If you’re a sole trader with £55,000 profit, the total tax payable has increased by £567.90.

How is the Health and Social Care Levy collected?

There’s no need to change anything that you’re doing, as the increased NIC and Health and Social Care Levy will both be calculated in your Self Assessment tax returns, and paid in the normal way.

You’ll just need to account for these changes when setting aside your tax. Don’t forget that the Coconut app makes it really easy for you to do this: by collecting all of the relevant information about your income, expenses, and other contributing factors, our tax software will ensure you always have an accurate overview of how much you owe at your fingertips.

Other changes on the horizon

The other main thing to bear in mind over the next year is Making Tax Digital for Income Tax, which will cause some major changes to how sole traders manage and submit their taxes from 2024 onwards.

.png)