Here are five easy ways to trim your tax bill as a sole trader – a few small changes could help you keep more of what you earn.

Let’s face it – running your own business is hard enough without the tax stress. But the good news? A few small changes could help you keep more of what you earn.

Tax might not be the first place you look to save money, but making just a few smart moves can help you hold on to more of your hard-earned cash.

Here are five easy ways to trim your tax bill as a sole trader:

1. Claim every allowable expense

If you’re not claiming all your business expenses, you’re probably overpaying tax.

Allowable expenses are the costs of running your business – things like travel, phone bills, tools or office supplies. As long as it’s wholly and exclusively for work, it counts.

Forgot to claim something last year? No stress – you’ve got 12 months after the tax return deadline to fix it.

- Tip: If you use something for both business and personal use (like your phone), just claim the business-use bit – say, 60% of the bill.

2. Set up a home office

Already doing your admin, invoices or emails from home? Good news – you could be claiming for that!

By setting up a home office (even if it’s just the corner of a room), you can claim a portion of your household bills – like heating, electricity and broadband – as a business expense.

Just file these through your Self Assessment (SA103 form). You don’t need to send proof up front, but HMRC might ask for it later.

3. Pay into your pension

Contributing to a private pension doesn’t just build your future – it shrinks your tax bill too.

When you pay in, your provider automatically adds 20% tax relief. So for every £80 you pay, £100 goes into your pot. If you’re a higher-rate taxpayer, you can claim even more through your tax return.

- Tip: You can also save up to £20,000 a year tax-free in an ISA (including cash, stocks and shares, and Lifetime ISAs).

4. Use Marriage Allowance

If your partner earns less than £12,570 a year and you earn under £50,270, you could be missing out on a £252 tax saving.

With Marriage Allowance, they can transfer part of their Personal Allowance to you, reducing your Income Tax bill.

It’s free to apply – and you can even backdate your claim for up to four years.

5. Hire your spouse

If your partner helps you with admin, emails or invoices, you might be able to pay them – and cut your tax bill in the process.

As long as their work is real, their pay is fair, and it’s for your business, you can treat them like any other employee. This increases your business costs and lowers your profits (and therefore, your tax).

Just remember:

- They’ll need to go through payroll

- You must deduct any tax due

- You might need to pay employer NICs

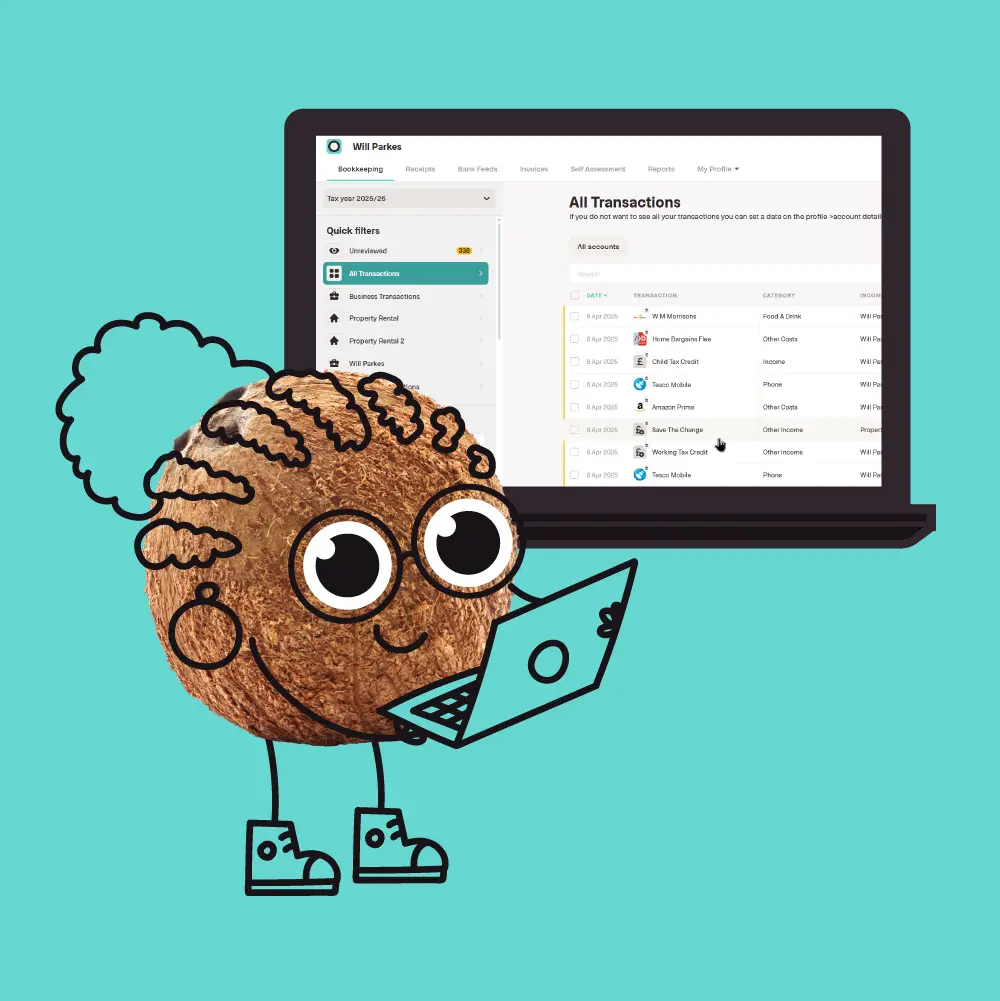

Are your business accounts driving you nuts?

Coconut makes invoicing and expense management for sole traders and landlords a breeze. Start your 30-day free trial now.